Investment: open source CRM Twenty

Enterprises are increasingly adopting open source not only in traditional areas like data & cloud infrastructure and dev tools but also in business suites like ERP and CRM. While this may seem unexpected, it can be explained from a historical perspective.

Many of these business software solutions originally began as B2B apps. Over time, additional app layers were built on top of them, so these extensive apps have sunk and evolved into essential enterprise infrastructure.

Open source as business infrastructure

Open source software works greatly for enterprise infrastructure, as it can cover the long tail of various business edge cases. It is cost-efficient, endlessly customizable, expandable, can be self-hosted, and has many other relevant virtues. This premise led to a notable wave of OSS business infra startups founded between 2004 and 2008, many of which later became unicorns (or nearly so):

- 2004: SugarCRM (CRM, "nine-figure" exit), Liferay (portals, 1.1K+ employees)

- 2005: Automattic (CMS, $7.5B valuation), Odoo (ERP, $4.3B)

- 2006: Kaltura (video platform, ~$0.3B market cap, $1.5B at peak)

- 2007: Magento (e-commerce, $1.7B exit), Acquia (DXP, $1B exit)

- 2008: Instructure (LMS, ~$3.5B market cap)

Around 2008, entrepreneurs largely stopped founding such startups for some reason (maybe, the GFC?). However, we are now witnessing a resurgence of open-source business solutions as enterprises become more tech-savvy, cost-conscious, and increasingly inclined to invest in OSS-based infrastructure.

Today, I am excited to share that we have led a $5M seed round for a remarkable company that exemplifies this new wave: Twenty, a fast-growing open-source CRM platform. It aligns perfectly with one of my preffered OSS investment profiles and has several notable aspects worth discussing.

Why does the world need one more CRM?

The realm of large enterprise suites continues to be dominated by legacy closed-source ecosystems, which can be disrupted by competitive open source newcomers. Take, for example, enterprise ERPs: many startups tried to disrupt this market in the last 20 years, but only the open-source platform Odoo has successfully challenged giants like SAP and Oracle in a few niches. As of 2023, it's the Belgium’s most valuable tech company with $450M ARR, growing 55% year-over-year.

Similarly, the CRM market, which is expected to expand from $100 billion to over $250 billion in the next eight years, is largely controlled by legacy vendors, with Salesforce leading the pack with ~21% share (peaked at 23% in 2021).

Similarly, the CRM market, which is expected to expand from $100 billion to over $250 billion in the next eight years, is largely controlled by legacy vendors, with Salesforce leading the pack with ~21% share (peaked at 23% in 2021).

Salesforce's dominance isn't just about its product—it's about the vast network of developers and partners facilitating integration and customization. Many enterprises find themselves hostages to proprietary, expensive systems, limiting flexibility and control. As companies prioritize data privacy and ownership, and as CRMs become tightly integrated with data & AI stacks, the need for open, flexible platforms that enable businesses to truly own their stack becomes critical.

Numerous attempts have been made to build the "next Salesforce" (~$300B market cap), with notable cases including Hubspot (~$30B market cap) and Pipedrive (acquired for $1.5B). However, no closed-source startup has managed to outcompete established CRM behemoths. Could an open-source solution do this?

Meet Twenty — the #1 open-source CRM

Building a next-gen enterprise CRM is a hard and long-term journey; so few founders even try. Fortunately, Twenty's founders are experienced entrepreneurs who are ready to make such bold bets — Félix and Charles sold their previous startup to Airbnb, and Thomas is also a repeat entrepreneur. I was highly impressed by their vision at our first meeting in August 2023, and now it’s clear that its early implementation resonates with the market very well too.

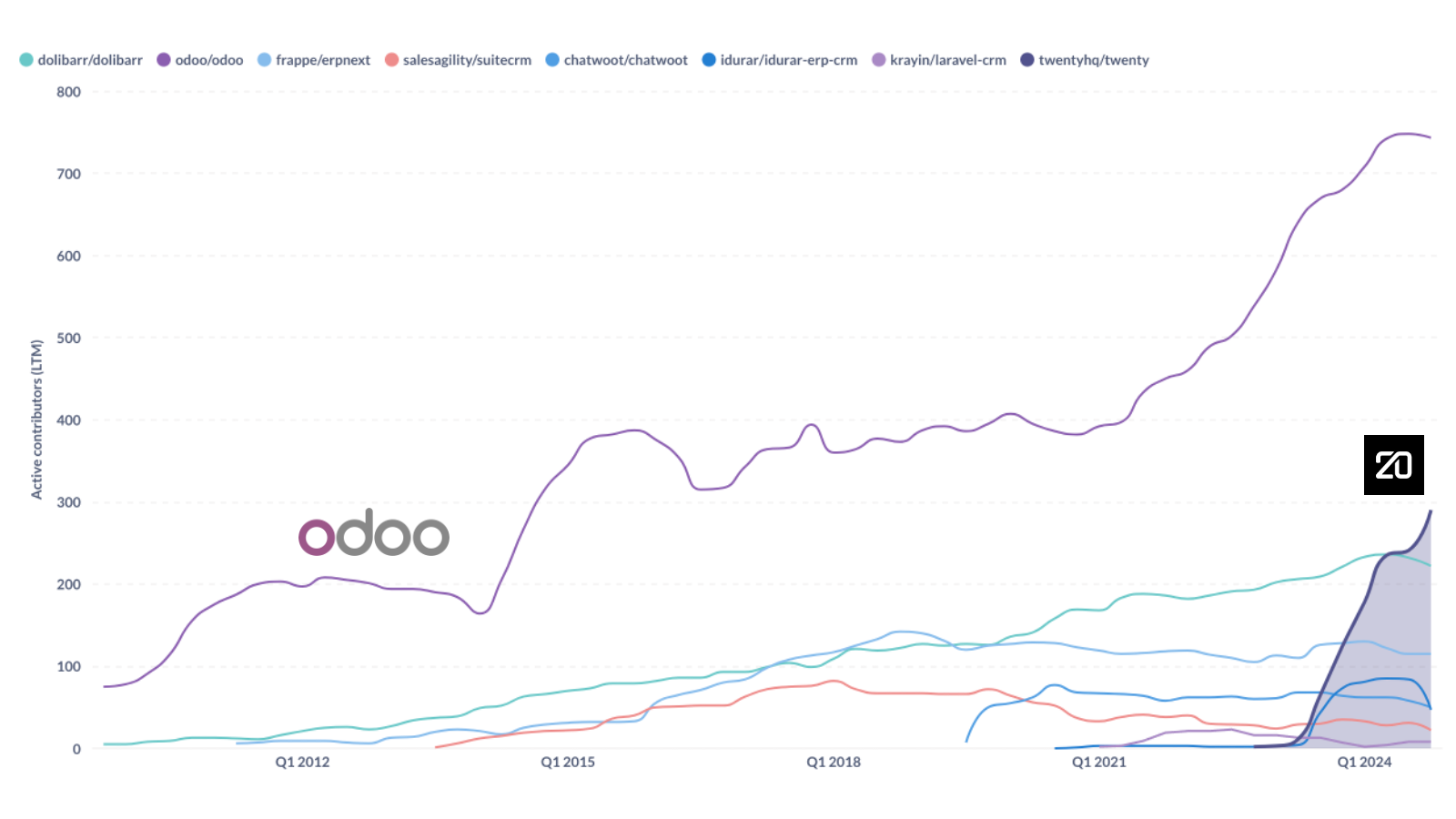

Since its launch on Hacker News in July 2023, Twenty has become the leading open-source CRM in the world by the activity of its open-source community, overcoming not only other OSS CRM projects but also exceeding the level of Odoo's ecosystem when it raised Series B in 2014. It can be measured by the number of active contributors in the last twelve months (LTM) in the corresponding GitHub repos.

Now twentyhq/twenty has more than 280 active contributors (LTM), and out of 220+ million public GitHub repos, only 157 repos have at least the same contributors' activity (~350 ever had!). Moreover, these repos belong to no more than 120 ultimate owners, which include only 42 product-focused tech companies:

-

16 public: Apple, Baidu, Broadcom, Cisco, Cloudflare, Elastic, Expensify, Google, IBM, Intel, Meta, Microsoft, MongoDB, Oracle, Raspberry Pi, and Spotify.

-

26 private: Anaconda, Astral, Astro, Automattic, Bun, Clickhouse, Dify, Expo, Gitpod, Grafana, HuggingFace, JetBrains, LangChain, Laravel, Liferay, LiteLLM, LLamaIndex, Mend, Obsidian, Odoo, Raycast, Supabase, Symfony, Twenty, Vercel, and Zed.

Twenty is swiftly shipping foundations of a modern enterprise CRM platform: open-source, data-centric, AI-native, highly customizable, and extendable. The product has already attracted the attention of enterprises and consultancies, with one even implementing Twenty at a top-10 U.S. bank. Given our enthusiasm for data-driven sourcing and automation, Runa also plans to transition from Affinity to Twenty.

It will be a long journey, and the founders have assembled an exceptional team to manage it. We are honored to co-invest alongside numerous CRM and OSS experts, including Dharmesh Shah (HubSpot), Sergey Anikin (ex Pipedrive), Mathilde Collin (Front), Walter Kortschak (Firestreak, Summit Partners), Matt Mullenweg (Automattic), Darian Shirazi (Gradient, ex Radius Intelligence), Jonathan Golden (NEA), Yuri Sagalov (Wayfinder), David Cramer (Sentry), Peer Richelsen(Cal.com), Jean-Charles Samuelian-Werve (Mistral AI) and many others.

Now, if you need a modern customizable CRM with a vibrant, fast-growing open-source community, you know where to find it. Go Twenty!