More Open Source Benchmarks, the ROSS Index and the Fastest-Growing OSS Startups

After the success of my previous post on open-source benchmarks, it has become clear that: (1) tech companies and VCs eager to monitor fresh fast-growing OSS startups, and (2) repos based on various programming languages need additional benchmarks. So this article extends the benchmarks, introduces such a monitoring tool and unveil a new set of 20 fastest-growing open-source startups (based on Q3 2020 data).

⚙️ Programming Language Matters

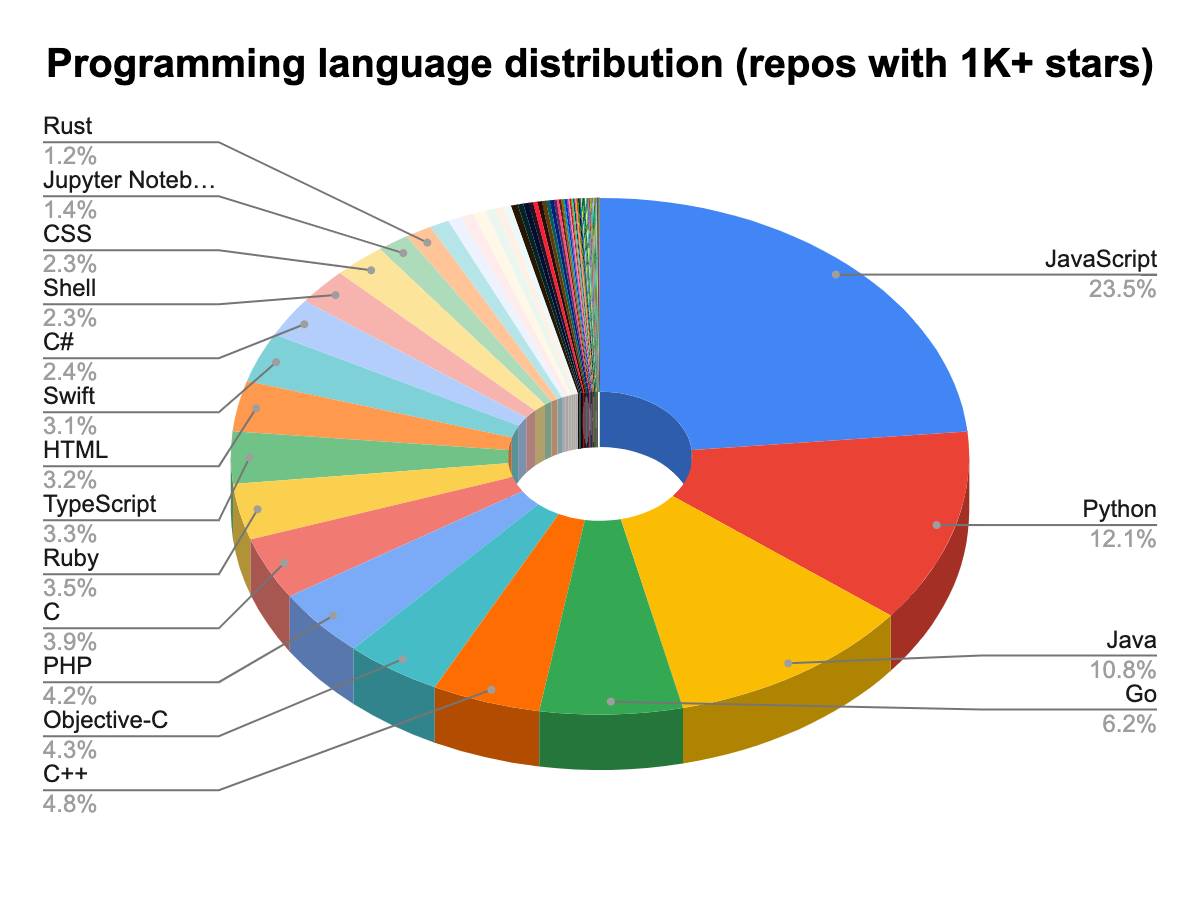

One of the missing parts of open-source growth benchmarks were metrics for various programming languages. Obviously, it's better to compare apples to apples, not JavaScript to C++ repos. So I analyzed the distribution of star growth for repositories depending on their main language.

One could use data on ~26K Github repos having 1K+ stars at the beginning of Q2 2020 and examine their growth by stars over the following 6 months.

For the sake of convenience, let's focus only on the most popular languages representing ~3/4 of the dataset. They are JavaScript, Python, Java, Go, C, C++, PHP Objective-C, Ruby.

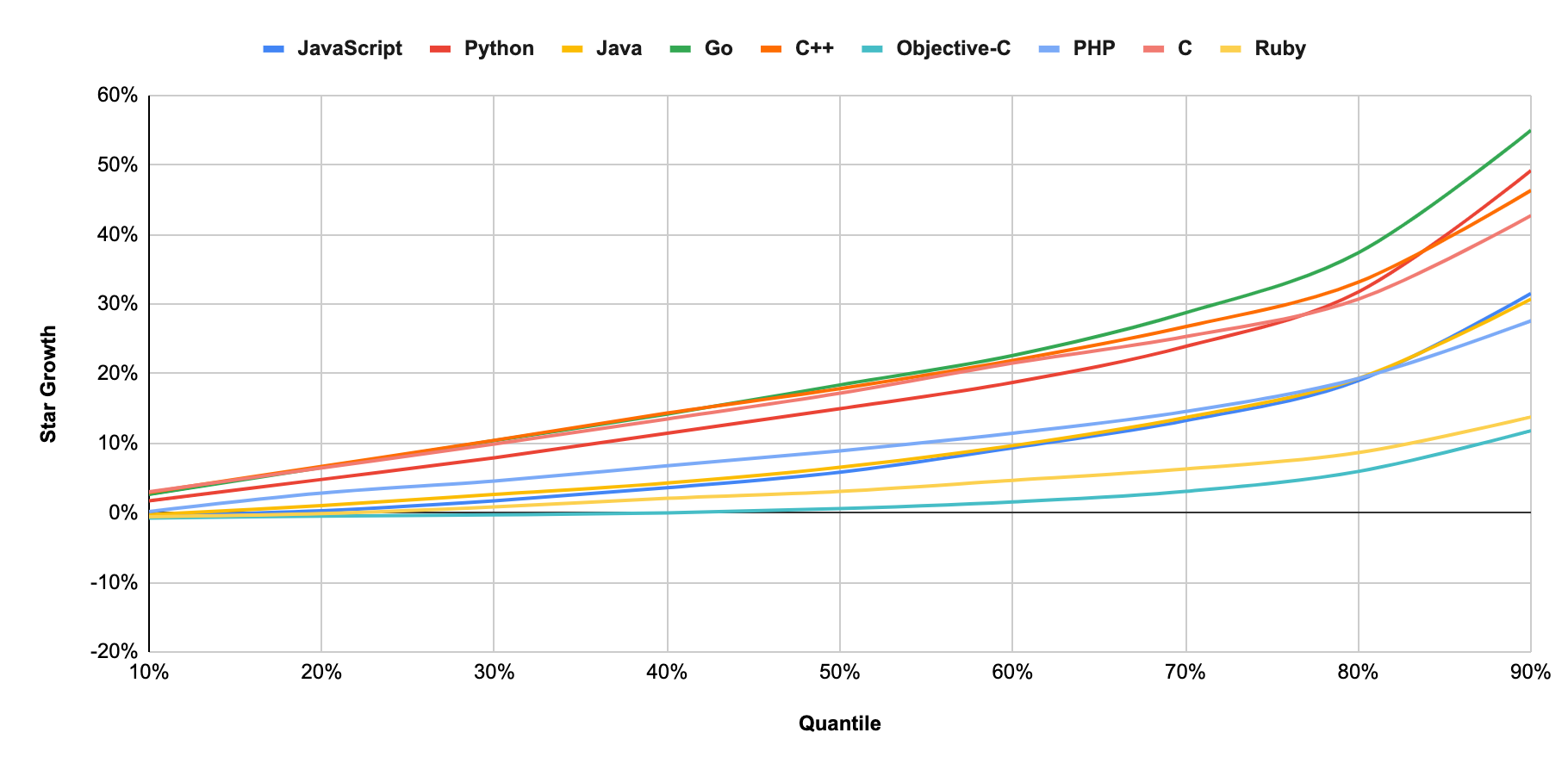

Like last time, we will use an annualised growth rate [AGR = (value now / value 2 quarters ago)² — 1] to represent growth of stars in the year-over-year format. One can plot the distribution chart, showing for every language [legend] that X% of its repos [x-axis] grow <Y% per year [y-axis].

For instance, 60% of Java repos grow slower than 10% annually, 55% of Go repos grow slower than 20% annually. The extreme cases of the fastest (about 90% quantile) and the slowest (below 10% quantile) repos are intentionally excluded to show the general picture.

For instance, 60% of Java repos grow slower than 10% annually, 55% of Go repos grow slower than 20% annually. The extreme cases of the fastest (about 90% quantile) and the slowest (below 10% quantile) repos are intentionally excluded to show the general picture.

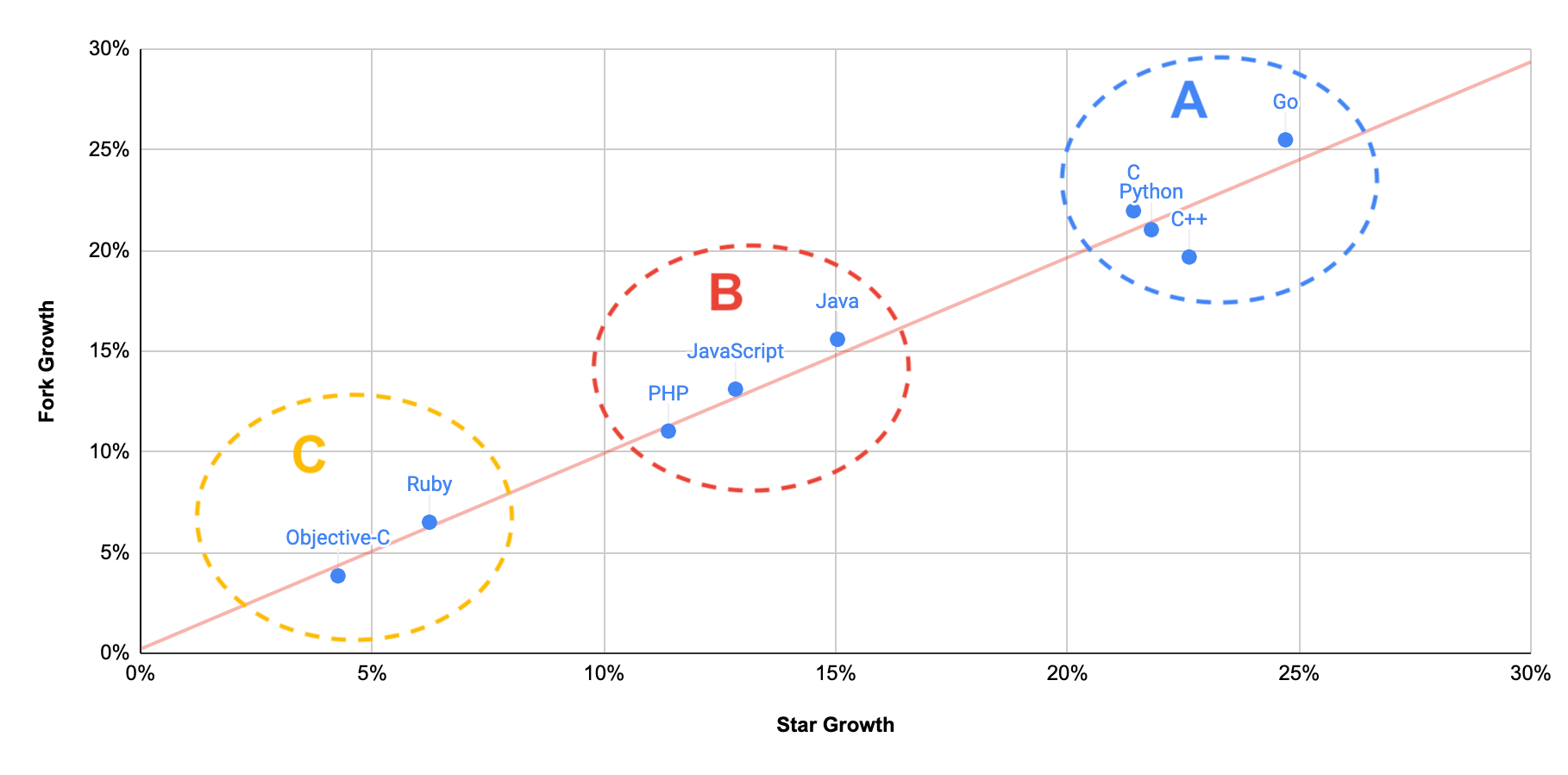

Surprisingly, 3 clear groups appear among the top languages:

-

Group A (Go, Python, C++, C) includes trendy languages mostly used for back-end software development. A repo based on any of these languages grows better than the average if its annual growth rate exceeds 17%.

-

Group B (Java, JavaScript, PHP) combines a couple of popular web development languages and Java, which seems to have much more common with JavaScript besides its name 🙂

-

Group C (Ruby, Objective-C) is the slowest growing set of languages losing popularity in the developer community. According to Github Language Stats share of Ruby pull requests at Github has dropped 3 times from its peak in 2012 to 6.5% in 2020. Objective-C dropped 5x since 2014.

For those who care: Fork Growth = 0.97 x Stars Growth (R² = 98%)

For those who care: Fork Growth = 0.97 x Stars Growth (R² = 98%)

In a nutshell, the propagation of Github popularity really depends on programming languages and corresponding development cultures.

📈 Meet our Open Source Startup Index

The idea of the software-focused index is not radically new. There are 2 well-known stock market indexes by venture funds (Bessemer, OpenView), and even a few projects about private open-source companies.

They all are cool for selected niches, but miss a combo of features required for being an OSS startup index: focus on startups and a measurable approach to creating/updating a list:

- In 2013 Joseph Jacks (OSS Capital) introduced the COSS Index featuring the companies with $100M+ revenues heavily relying on open source. It is a perfect hall of fame for commercial OSS but is not about startups.

- In 2017 Battery Ventures published own BOSS Index. It had a nice name and original quantitative method for the selection, but the index's first release was the last one. The project is dead for years. It also focused more on open-source projects (not companies) and mixed startups (like Nginx) with large established corporations (like RedHat) in one list.

- In 2020 Accel launched the Open100, a collection of the fastest-growing OSS startups. No measurable methodology or an update period was introduced, so I hardly can call it an index (while the list is very good!).

So let me introduce the Runa Capital's Open Source Startup (ROSS) Index (see at runacap.com/ross-index) having all the required features above. It is transparent, measurable and fully focused on open-source startups.

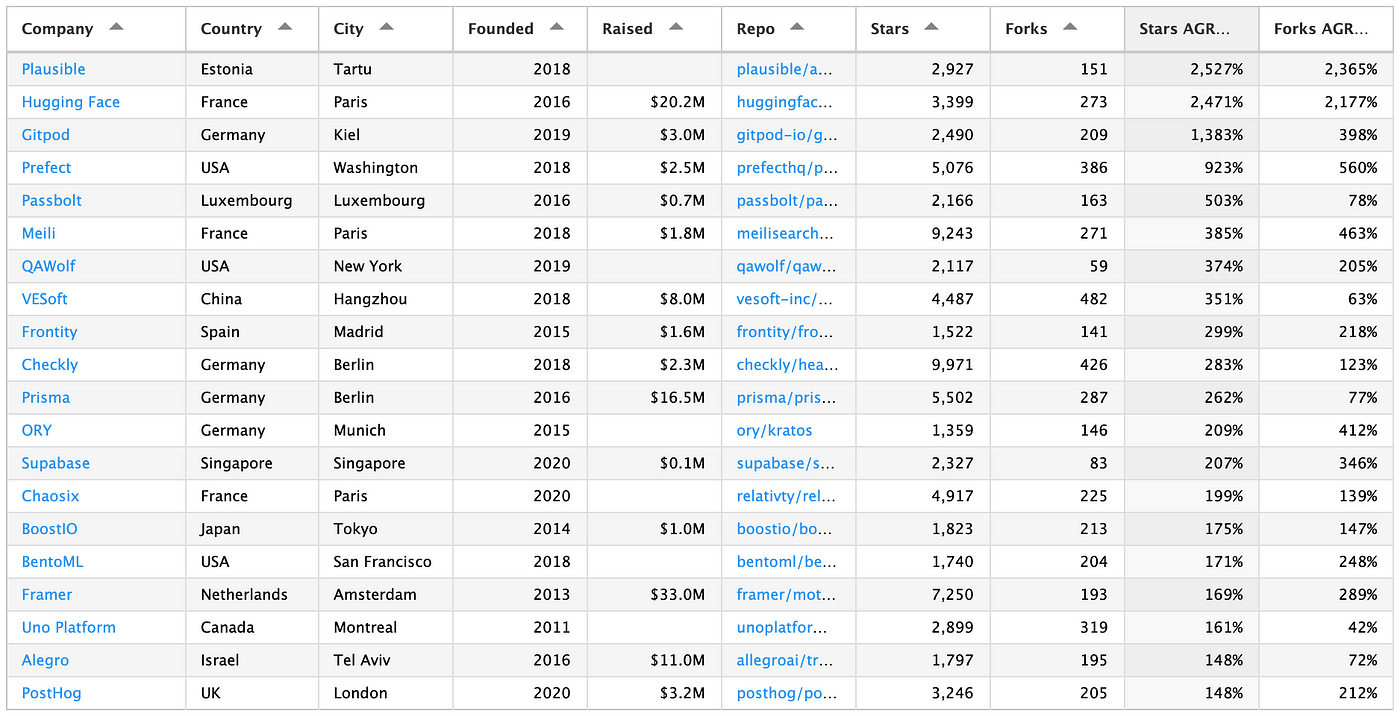

The ROSS Index consists of the 20 fastest-growing OSS startups and uses a methodology, which was introduced previously and based on AGR for Github stars. We will update the ROSS index every quarter.

While Github stars are not a perfect parameter for open-source project evaluation, they highlight new fast-growing startups on top of developers' mind. This is a quantitative metric we could start with.

Note that, our index is a live evolving project and fully open for contributions from the OSS community. Don't hesitate to share your comments and ideas regarding its development with me.

Finally, let's take a look at the recent catch of the ROSS Index in Q3 2020.

🦄 Top-20 startups by Github star growth (Q3 2020)

The leaderboard is highly dynamic, and only 4 companies (Hugging Face, Meili, Prisma, Framer) have remained in the index since last quarter. Hugging Face even managed to make it with its another repo. Also, two fast-growing startups were excluded from the list because they were acquired in Q3 by large companies (Rancher — by SUSE in July, Lens — by Mirantis in August).

- Plausible (plausible/analytics, 2.9K stars, 2527% AGR). Web analytics service (an open-source alternative to Google Analytics). Founded in 2018 in Estonia. Noteworthy, its founders do not raise external funding to remain a fully independent analytics company.

- Hugging Face (huggingface/datasets, 3.4K stars, 2471% AGR). The developer of the NLP-library Transformers, that debuted in the previous issue of our index. Founded in 2016 in Paris and raised $20.2M from Lux Capital, SV Angel, A.Capital, etc.

- Gitpod (gitpod-io/gitpod, 2.5K stars, 1383% AGR). Cloud integrated development environment (IDE). Founded in 2019 in Kiel, Germany and raised $3M from Speedinvest, Crane Venture Partners, Vertex Ventures.

- Prefect (prefecthq/prefect, 5.1K stars, 923% AGR). Data workflow automation platform. Founded in 2018 in Washington, D.C., and raised $2.5M from unknown investors.

- Passbolt (passbolt/passbolt_api, 2.2K stars, 503% AGR). Password manager for teams. Founded in 2016 in Luxembourg and raised ~$0.74M from Expon Capital.

- Meili (meilisearch/meilisearch, 9.2K stars, 385% AGR). API-focused fast search engine (an alternative to ElasticSearch and Algolia). Founded in 2018 in Paris and raised $1.5M from LocalGlobe, Seedcamp, Kima, etc.

- QAWolf (qawolf/qawolf, 2.1K stars, 374% AGR). Browser testing service. Founded in 2019 in New York and has no known external funding to date.

- VESoft (vesoft-inc/nebula, 4.5K stars, 351% AGR). The developer of distributed and fast graph database NebulaGraph. Founded in 2018 in Hangzhou, China and raised $8M from Redpoint and Matrix Partners.

- Frontity (frontity/frontity, 1.5K stars, 299% AGR). React framework for building headless WordPress websites. Founded in 2015 in Madrid and raised $1.6M from K Fund.

- Checkly (checkly/headless-recorder, 10K stars, 283% AGR). Active monitoring and end-to-end-testing platform for developers. Founded in 2018 in Berlin and raised $2.3M from Accel, etc.

- Prisma (prisma/prisma, 5.5K stars, 262% AGR). Database toolkit for TypeScript and Node.js. Founded in 2016 in Berlin raised $16.5M from Kleiner Perkins, Mango Capital, Amplify Partners, etc.

- ORY (ory/kratos, 1.4K stars, 209% AGR). Identity and access control infrastructure for cloud developers. Founded in 2015 in Munich and has no known external funding to date.

- Supabase (supabase/supabase, 2.3K stars, 207% AGR). Low-code API solution for PostgreSQL database (an open-source alternative to Firebase). Founded in 2020 in Singapore and raised $125k from Y Combinator.

- Chaosix (relativty/relativty, 4.9K stars, 199% AGR). Stealth-mode VR startup by creators of open-source VR headset Relativty. Founded in 2020 in Paris and raised the unknown amount from The Family.

- BoostIO (boostio/boostnote.next, 1.8K stars, 175% AGR). The creator of Boosthub, a collaborative platform for developers. Founded in 2014 in Tokyo and raised ~$0.95M from ANRI, F Ventures, etc.

- BentoML (bentoml/bentoml, 1.7K stars, 171% AGR). A platform for high-performance ML model serving. Founded in 2018 in San Francisco and raised the unknown amount from Alchemist Accelerator.

- Framer (framer/motion, 7.3K stars, 169% AGR). Prototyping tools for teams trending with its OS library Motion. Founded in 2013 in Amsterdam and raised $33M by from Atomico, Accel, Foundation Capital, etc.

- Uno Platform (unoplatform/uno, 2.9K stars, 161% AGR). An app development platform for C# and WinUI. Founded in 2011 in Montreal and has no known external funding to date.

- Alegro (allegroai/trains, 1.8K stars, 148% AGR). A platform for the management of ML products life-cycle. Founded in 2016 in Tel Aviv and raised $11M from MizMaa Ventures, Samsung Catalyst, Hyundai, etc.

- PostHog (posthog/posthog, 3.2K stars, 148% AGR). Product analytics service (an open-source alternative to Mixpanel). Founded in 2020 in London and raised $3M from 1984 Ventures, Y Combinator, etc.

Update (22 Oct 2020). The initial version of Q3 index missed 2 companies (Checkly, Alegro) due to imperfect manual detection process of 20 startups out of 1000+ fastest-growing repos. Thanks to the bug report, it was quickly fixed, while we will add more checks in the future and improve the process.

The companies shifted to #21 and #22 positions are:

- Pomerium (pomerium/pomerium, 1.9K stars, 141% AGR). Identity and access security for cloud applications. Founded in 2019 in San Diego and raised $1.5M from Haystack.

- Parity (paritytech/substrate, 3K stars, 135% AGR). A blockchain infrastructure developer, mostly known for its involvement in Polkadot blockchain. Founded in 2015 in London and raised $5.8M from Fenbushi Capital, Blockchain Capital, etc. (Polkadot has separated large funding).