Open Source Growth Benchmarks and the 20 Fastest-Growing OSS Startups

Venture capitalists tend to invest in fast-growing companies and often use benchmarks to categorize startups by their growth. There are plenty of battle-tested metrics for SaaS (for instance: Scale VP, Serena, OpenView), but nothing actionable for open-source software (OSS) yet. This article is addressing this issue.

At Runa, we invest in OSS (like Nginx and MariaDB) and understand how a large and engaged developer community could be instrumental in building a successful enterprise software business. Thanks to Github, it is possible to assess the popularity of repositories (by ⭐️stars &🍴forks), introduce high-growth benchmarks and detect startups having the best momentum in terms of developers’ attention/engagement. So let’s do it.

📈 Power Laws of Open Source

I used Github API to collect data on all its repositories with 1000+ stars at the beginning and the end of Q2 2020. The resulting dataset contains more than 24,000 repositories and seems sufficient to understand some of the basics of the open-source world.

Github repositories have appeared to be a winner-take-almost-all market (a typical case for the tech industry), where just a few projects grab the most of developers’ attention. For instance, the top-15% repositories collected 51% of all stars in our dataset.

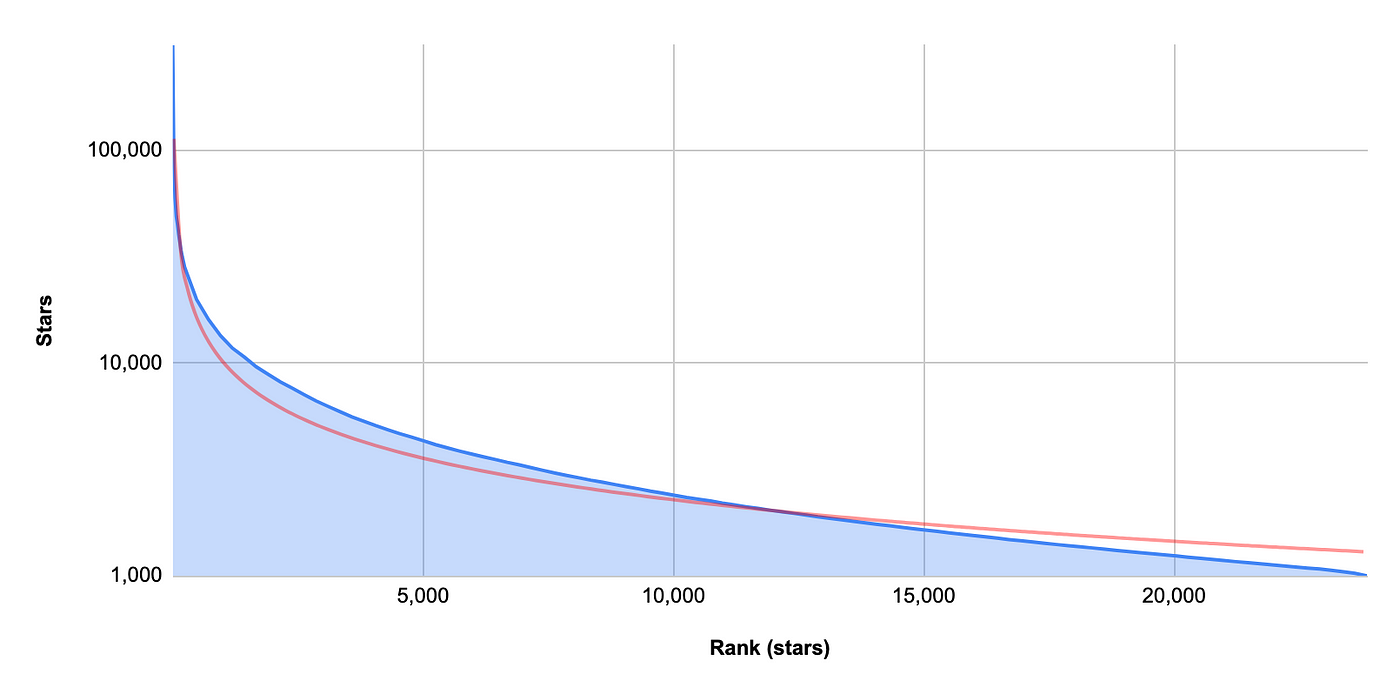

To understand the distribution we can plot repositories’ stars sorted from the most starred repo (freeCodeCamp, ~312K stars) to 1000-star projects. The log scale helps to properly represent this dependency… and it looks like a power law!

The blue line represents numbers of stars sorted from the largest to the smallest (actually, by repo’s star rank). It is well-approximated by a power law (the red trend line, R² = 98%): Stars = 900K x Star_Rank ^ (–0.649)

The blue line represents numbers of stars sorted from the largest to the smallest (actually, by repo’s star rank). It is well-approximated by a power law (the red trend line, R² = 98%): Stars = 900K x Star_Rank ^ (–0.649)

Now if somebody pitches its “outstanding open-source traction” with ~1500 stars at the repo, some VC can answer “OK, but 16K+ repos did the same” (well, it could be still a very promising startup but by other reasons).

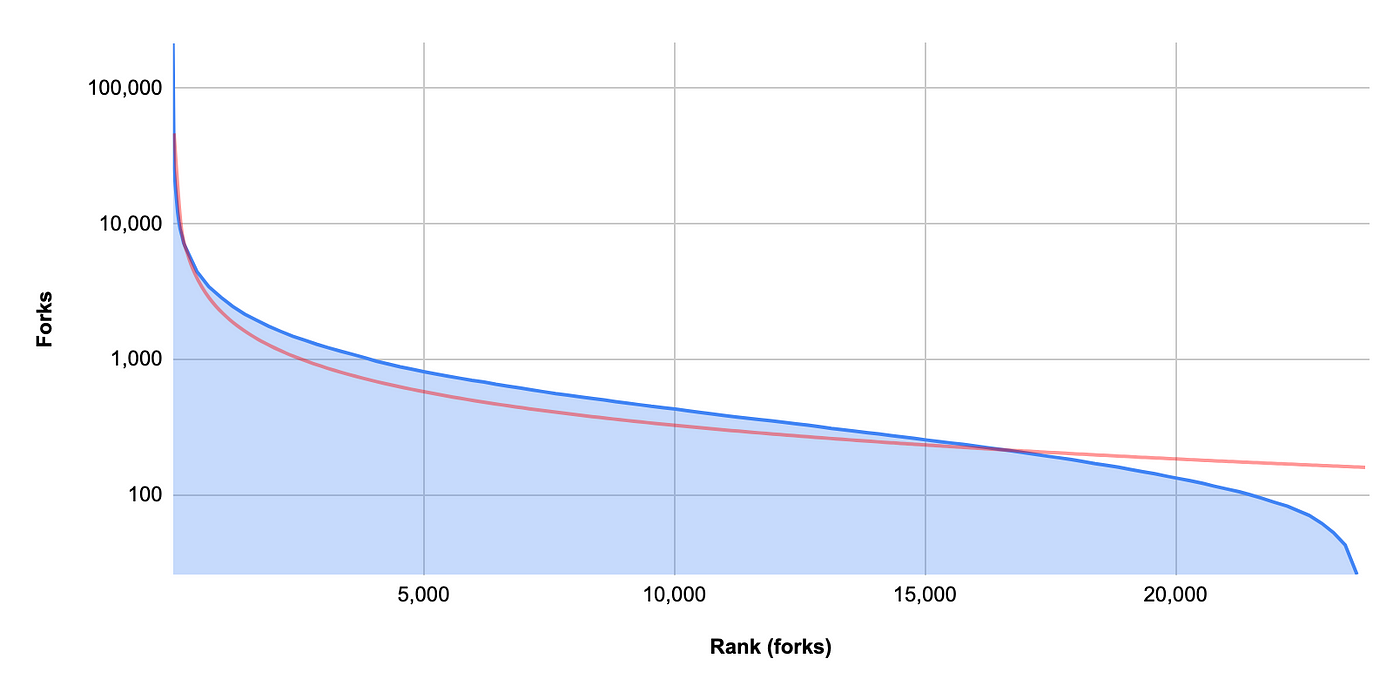

The developers’ engagement is a hard metric to measure, but very roughly it could be estimated by the number of forks. Many projects with 1000+ stars do not have them — people tend to mark them as favourites and don’t publicly play with the code by themselves. We can also see a power law here:

The blue line represents numbers of forks sorted from the largest to the smallest (by repo’s fork rank). It also obeys a power law for repos with 100+ forks (the red trend line, R² = 92%): Forks = 644k x Forks_Rank ^ (-0.823)

The blue line represents numbers of forks sorted from the largest to the smallest (by repo’s fork rank). It also obeys a power law for repos with 100+ forks (the red trend line, R² = 92%): Forks = 644k x Forks_Rank ^ (-0.823)

🚀 Growth benchmarks

Accounting the limited timeline of the dataset we can use an annualised growth rate [AGR = (value now / value 1 quarter ago)⁴ - 1] to show the dynamics of repositories in the year-over-year format. Unsurprisingly, the growth of stars and forks obeys the ubiquitous power law.

How can we use it to benchmark startups? Revenue growth rates usually decline at a higher revenue level (e.g. see a dependency for SaaS) and it makes sense to compare them only within the peer group. Let’s apply the same approach for open-source popularity metrics.

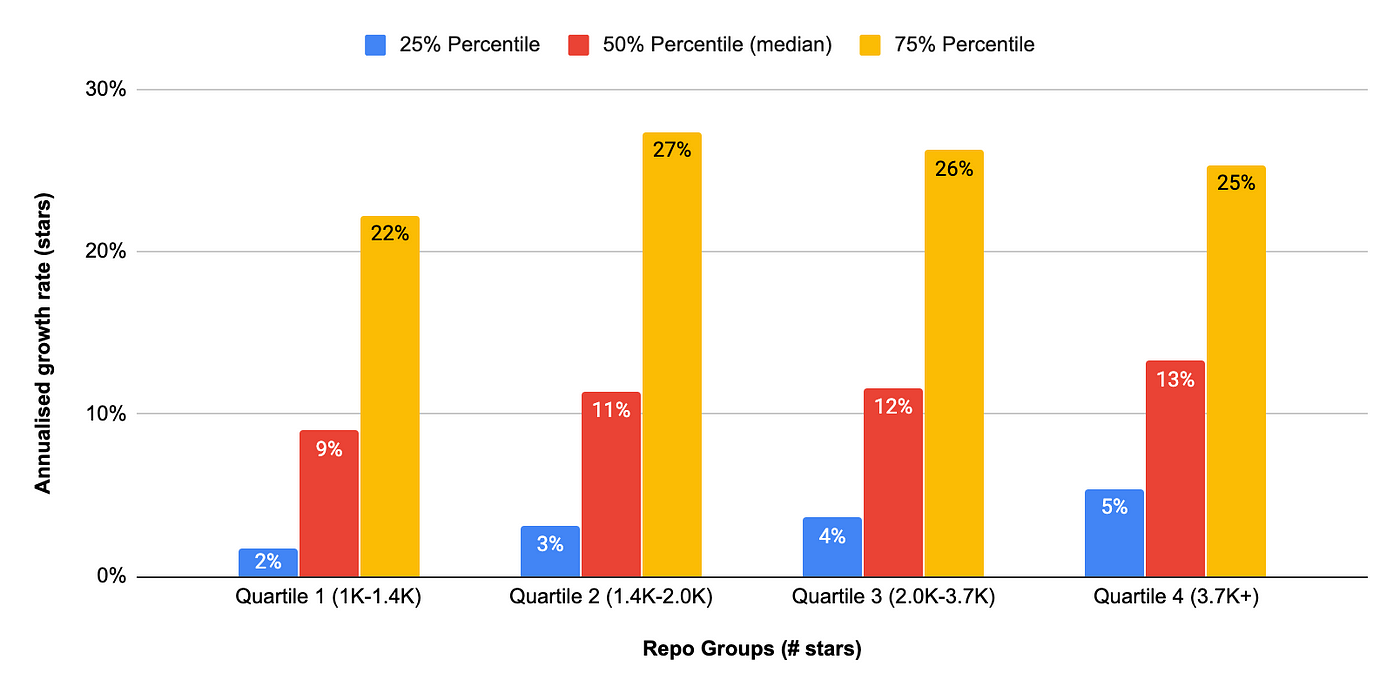

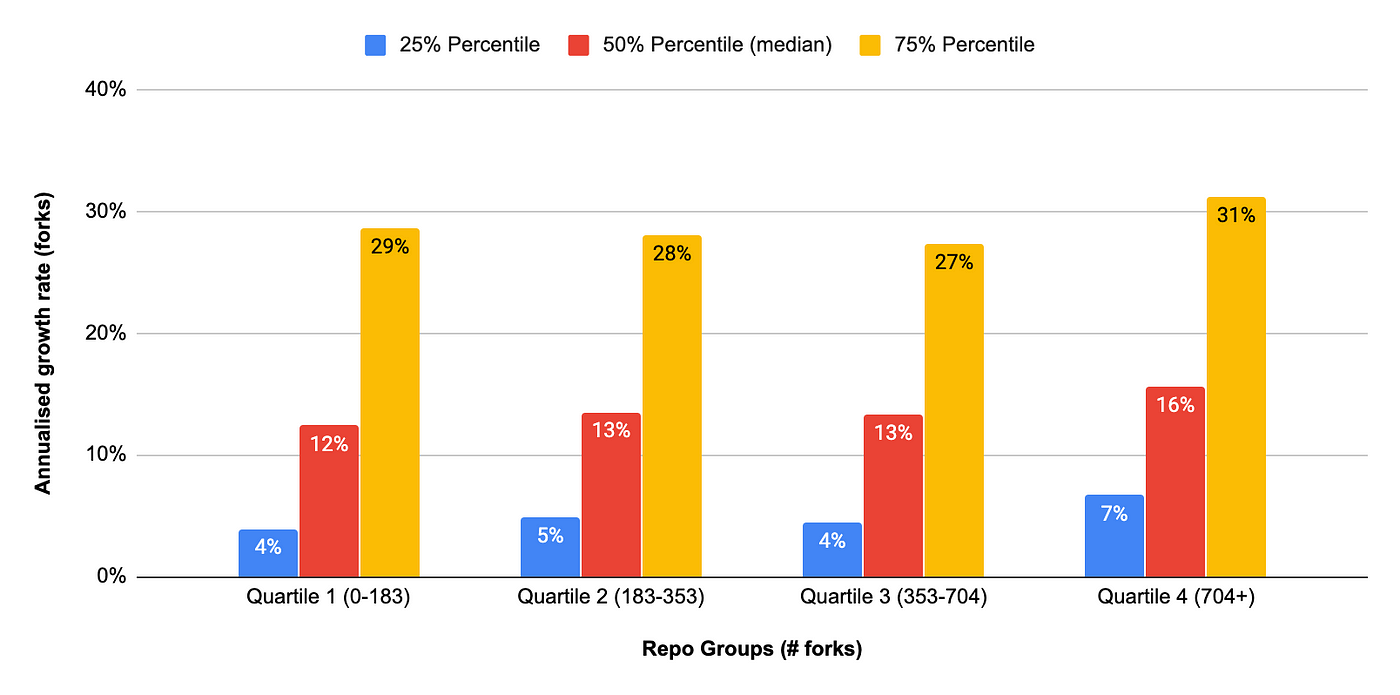

I divided all considerable repositories into four quartile groups (25% of repos each) by stars and forks. They differ a lot due to a power law — for example, the lower quartile consists of repos with 1–1.4K stars, while repos of the upper have 3.7K– 312K stars. Now we can see how growth rates change at scale:

The chart shows growth percentiles for stars quartiles 🤓. In simple words — for example, 50% of repos with 3.7K+ stars grow more than +13% per annum, and top-25% of repos with 2–3.7K stars grow more than +26%.

Unexpectedly, the median for growth increases with the number of stars, that is totally counterintuitive. For instance, usual revenue growth benchmarks have the opposite dynamics. In other words — the more stars your repo has, the faster it grows (in %). Forks have the same issue:

🦄 20 fastest-growing open-source startups

The intersection of upper quartiles by stars (>3.7K) and star growth (>25%) contains the best projects— with already significant open-source traction and highest growth rates. But most of them are free community projects and do not pretend to become a $1B+ software company.

After further research I detected startups, repositories of those showed the strongest growth in Q2 2020 (a “startup” is defined here as a product-focused commercial organisation with <$100M funding and <10 years old):

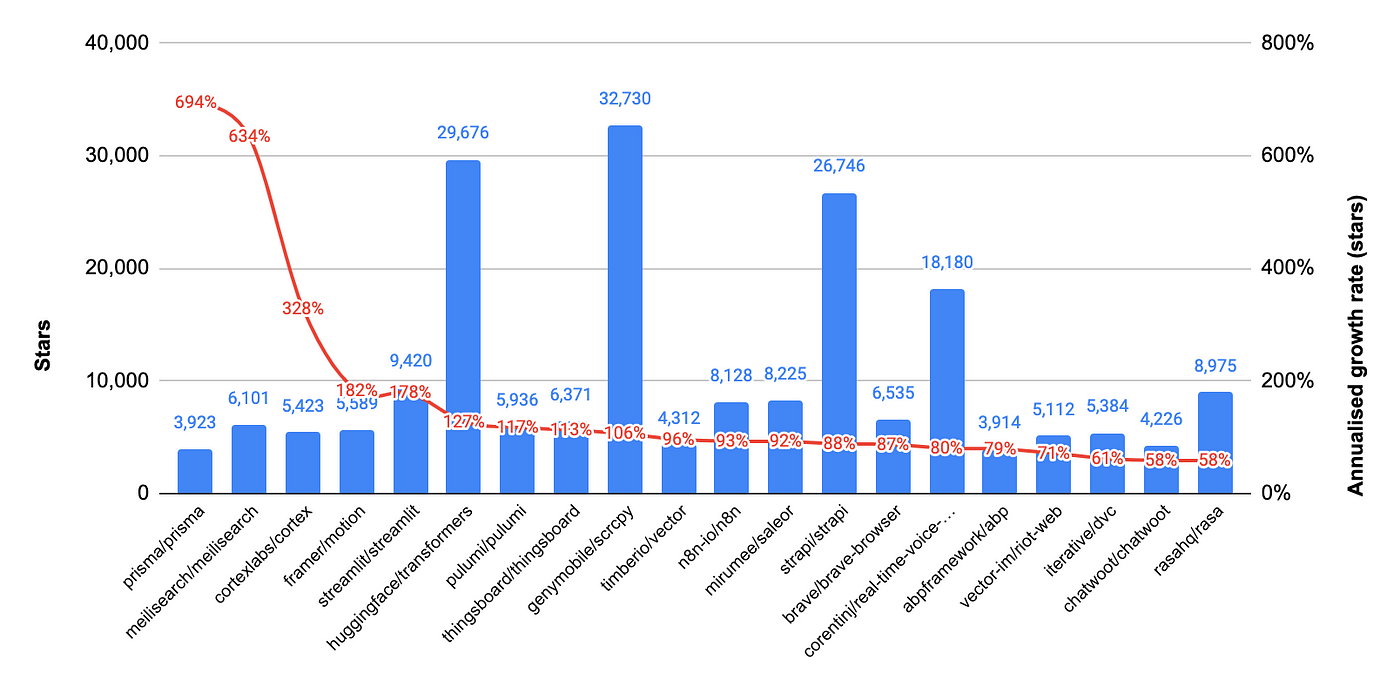

The top-20 fastest-growing repositories of startups in Q2 2020.

The top-20 fastest-growing repositories of startups in Q2 2020.

Most of the successful open source startups typically end up with an HQ in San Francisco Bay Area but could be founded everywhere. Noteworthy, 80% of the fastest-growing companies from the list were founded outside the Bay Area. A breeding ground for open-source startups is Europe — 12 out of 20 top startups were originated there, including 4 from Paris and 3 from Berlin.

Four repositories have an impressive combination of massive growth and numbers of stars — 3 from France (huggingface, genymobile, strapi) and 1 from the eastern part of Canada (corentinj). Maybe the French language has a feature allowing to maintain high growth of OSS popularity at scale 😂

Finally, a methodological remark — 5 organisations could gain momentum due to well-promoted funding announcements in Q2 (prisma, streamlit, strapi, vector-im, rasahq) and 2 organisations were intentionally excluded from the list because they are not “startups”: Fast.ai (non-commercial), Aqua Security (raised $100M+). Enjoy the list!

Top-20 startups by Github stars growth in Q2 2020:

-

Prisma (prisma/prisma, 3.9K stars, 694% AGR). Database tools for TypeScript and Node.js. Founded in 2016 in Berlin and raised $16.5M from Kleiner Perkins, Mango Capital, Amplify Partners, etc

-

Meili (meilisearch/meilisearch, 6.1K stars, 634% AGR). API-focused fast search engine (an alternative to ElasticSearch). Founded in 2018 in Paris and has no known external funding to date.

-

Cortex Labs (cortexlabs/cortex, 5.4K stars, 328% AGR) — API platform for deployment of ML models (an open-source rival to AWS SageMaker). Founded in 2018 in Oakland, CA and has no known external funding.

-

Framer (framer/motion, 5.6K stars, 182% AGR) — Browser-based design tools for teams trending with its open-sourced library Motion. Founded in 2013 in Amsterdam and raised $33M by from Atomico, Accel, Foundation Capital, etc.

-

Streamlit (streamlit/streamlit, 9.4K stars, 178% AGR) — Framework for fast development of frontend data apps, increasing the productivity of data science and machine learning teams. Founded in 2018 in San Francisco and raised $27M from GGV Ventures, Gradient Ventures, Bloomberg Beta.

-

Hugging Face (huggingface/transformers, 29.7K stars, 127% AGR) — Developer of the natural language processing library Transformers and a popular AI-based chatbot for teenagers. Founded in 2016 in Paris and raised $20.2M from Lux Capital, SV Angel, A.Capital, etc

-

Pulumi (pulumi/pulumi, 5.9K stars, 117% AGR) — Platform for cloud app development and deployment. Founded in 2017 in Seattle and raised $20M from Madrona Venture Group and Tola Capital

-

ThingsBoard (thingsboard/thingsboard, 6.4K stars, 113% AGR) — IoT platform for data collection, processing, visualisation and device management (an open-source alternative to IoT @ AWS/Azure/GCP). Founded in 2016 in Kyiv and has no known external funding.

-

Genymobile (genymobile/scrcpy, 32.7K stars, 106% AGR) — Solutions for development and testing of Android apps. Founded in 2011 in Paris and raised $9.7M from Alven and BPI France.

-

Timber (timberio/vector, 4.3K stars, 96% AGR) — Developer-focused cloud logging system. Founded in 2016 in New York and raised $5.8M from NextView Ventures, Notation Capital, etc

-

N8N (n8n-io/n8n, 8.1K stars, 93% AGR) — Workflow automation tool (an open-source alternative to Zapier). Founded in 2019 in Berlin and raised $1.5M from Sequoia, Firstminute Capital, Runa Capital.

-

Saleor (mirumee/saleor, 8.2K stars, 92% AGR) — Headless e-commerce platform. Founded in 2019 in Wroclaw, Poland and has no known external funding.

-

Strapi (strapi/strapi, 26.7K stars, 88% AGR) — Headless content management system. Founded in 2016 in Paris and raised $14M from Index Ventures, Accel, Stride.VC, etc.

-

Brave (brave/brave-browser, 6.5K stars, 87% AGR) — Next-generation secure and private browser. Founded in 2015 in San Francisco and raised $42M from Founders Fund, Foundation Capital, etc.

-

Resemble (corentinj/real-time-voice-cloning, 18.2K stars, 80% AGR) — AI engine for realistic voice cloning. Founded in 2018 in Toronto and raised $2M from GMG Ventures, Firstminute Capital, Canaan Partners, etc.

-

Volosoft (abpframework/abp, 3.9K stars, 79% AGR) — Software development tools trending with its open-source framework ABP for ASP.net. Founded in 2016 in Istanbul and has no known external funding.

-

Riot IM (vector-im/riot-web, 5.1K stars, 71% AGR) — Decentralised secure communication tools (ex Vector IM). Founded in 2017 in London and raised $18.1M from Dawn Capital, Firstminute Capital, Notion, etc.

-

Iterative (iterative/dvc, 5.4K stars, 61% AGR) — Version control system for datasets and machine learning models. Founded in 2018 in San Francisco and raised $3.9M from Afore Capital, True Ventures, etc.

-

Chatwoot (chatwoot/chatwoot, 4.2K stars, 58% AGR) — Live chats for customer support (an open-source alternative to Intercom). Founded in 2017 in Bengaluru, India and has no known external funding.

-

Rasa (rasahq/rasa, 9.0K stars, 58% AGR) — Conversational AI assistant. Founded in 2016 in Berlin and raised $40.1M from Andreessen Horowitz, Accel, Mango Capital, etc

🧠 Final Thoughts

The benchmarks above could be used to detect outstanding open-source startups. Stars, forks and their growth rates are measurable, but indirect factors of a product’s adoption within the global developer community.

Also don’t mix correlation with causation — lack of popularity at Github does not say about low quality and could be caused by various reasons. The best illustration is Runa’s ex-portfolio company Nginx (acquired for $670M) — it powers ~450M websites in the world and has just 12.2K stars at Github.